Simplify your new home financing.

Why Choose Our Preferred Lenders?

At Holt Homes, we're dedicated to making your home-buying journey as exhilarating as it is hassle-free. That's why we've carefully selected Borrow Smart Mortgage and US Bank as our trusted partners in lending.

With their profound expertise and a deep understanding of new construction homes, you can rely on them to simplify and streamline the lending process. We're here to ensure your path to homeownership is a smooth and transparent one.

Here are the benefits:

- Quick pre-qualification & pre-approvals

- Competitive interest rates, with potential incentives for Holt buyers to secure even lower rates

- Extended rate lock programs to provide you with peace of mind and protection against potential interest rate fluctuations

- Many different programs to choose from

- Free phone consultations

- Consistent status updates and communication throughout the process

Meet Your Lending Advisors

BorrowSmart and US Bank are seasoned experts in new construction financing. With a focus on personalized service, their dedication lies in guiding you through the lending journey seamlessly. Rest assured, they'll work closely with you to find the optimal financing solution for your new Holt Home. Your dream of homeownership is their priority!

Tom Griffith

BorrowSmart President/Loan Advisor

Carlene Smith

US Bank Loan Officer

6 Steps to Financing Your New Home

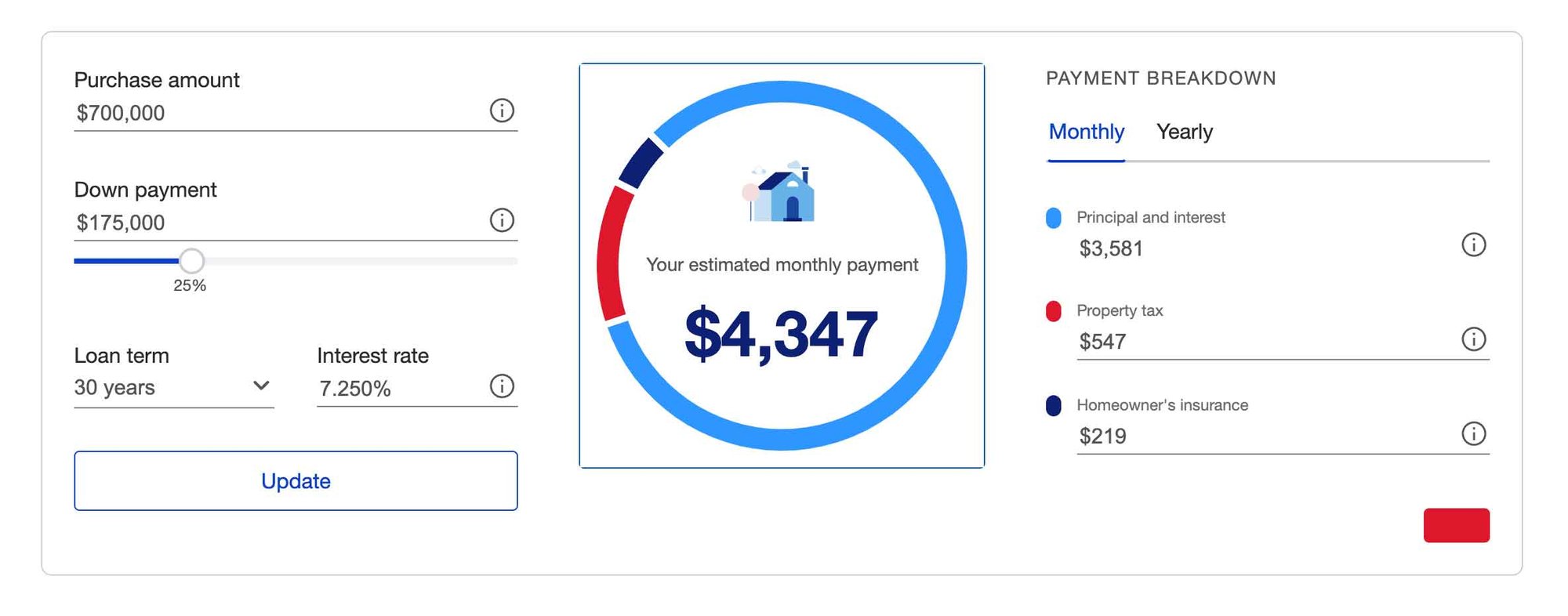

1. Set Your Budget

Determine your budget and get pre-qualified for a mortgage to know how much you can afford. Try our calculator above.

2. Find Your Holt Home

Explore Holt's communities and choose a floor plan that suits your budget and lifestyle. Work with a Holt sales representative to align on price and sign the sales agreement.

3. Secure Financing

Reach out to our Lending Advisors for a smooth financing process. Complete the loan application and obtain approval.

4. Personalize Your Home

Visit Holt's design center to select finishes, fixtures and features that will make your new home uniquely yours.

5. Monitor Construction

You'll be meeting with your superintendent, reviewing site plans, and attending key milestones during construction.

6. Close on Your Home

Finalize your mortgage, pay closing costs, and sign the paperwork at the closing meeting. Receive the keys to your new Holt Home!

Frequently Asked Questions

What is the benefit of using Holt's preferred lenders?

Using one of Holt's preferred lenders streamlines the financing process, ensuring smooth communication and a faster closing. Plus, you can enjoy benefits like better pricing, outstanding customer service, and expert knowledge of new construction and Holt communities.

Can I use my own lender instead of Holt's preferred lenders?

Yes, you can use your own lender. However, choosing one of Holt's preferred lenders provides a seamless process with perks like closing cost assistance and an in-depth understanding of Holt communities.

How do I get pre-qualified for a mortgage?

Pre-qualification involves discussing your financial situation with a lender, including income, debts, and assets. The lender will provide an estimate of how much you can borrow. With Holt's preferred lenders, BorrowSmart or USBank, you can start this process easily.

What is the difference between pre-qualification and pre-approval?

Pre-qualification is an initial assessment of your financial situation to estimate how much you can borrow. Pre-approval is a more in-depth process, where the lender verifies your financial information and commits to lending a specific amount.

Can I personalize my Holt Home during the financing process?

Yes, after purchasing a Holt Home, you'll have the opportunity to personalize your space at our design centers. Your preferred lender can discuss how these upgrades may affect your mortgage.

How long does the financing process typically take?

The financing process can vary depending on factors like loan type and approval speed. Typically, it takes around 30-45 days from application to closing. Working with Holt's preferred lenders can help ensure a smoother, faster process.

What if I've never purchased a home before?

No problem! As a first-time homebuyer, you may have many questions about the process. Our preferred lenders are experienced in guiding first-time buyers through every step of financing, from pre-qualification to closing. They'll provide expert advice and resources to ensure a smooth and stress-free experience.

What if I need help getting a down payment?

If you need assistance with your down payment, there are several options available, including down payment assistance programs and grants. Our preferred lenders can help you explore these options and determine which one is the best fit for your situation. They're committed to making the homebuying process accessible and achievable for everyone.

.jpg?height=200&name=Tehaleh%20model_%20lot%20748_2618D_2%20Car_%20(89).jpg)